How Much Money Do Database Companies Make? And How?

SingleStoreDB, where I’ve worked for the last 7+ years, has just publicly announced crossing the $100M Annual Recurring Revenue (ARR) milestone:

This is a big deal for the business, and I’m obviously thrilled about it. Achieving this milestone also got me thinking about how much revenue database companies have in general, and the different ways in which they generate it. So, I figured I’d write a blog post about all this as a way to help me structure my knowledge in this area.

Let's start by looking at a few database companies, and their revenue for the last 12 months [1][2]:

| Company | Revenue |

|---|---|

| Snowflake | $2.621 B USD |

| MongoDB | $1.586 B USD |

| Elastic | $1.159 B USD |

| Couchbase | $172 M USD |

| MariaDB | ~$55 M USD[3] |

But wait, where are all the other database companies?

- A lot of the most popular databases are free and open source (SQLite, PostgreSQL, Cassandra, etc.). There’s often multiple vendors who are selling services built on top of these databases.

- Most well-known databases are built by companies that sell a lot more than just databases. This means that there’s no easy way to know how much they make from their database products. This group includes Oracle, Microsoft, Google, Amazon, IBM and SAP.

- Some database companies are private, so their revenue numbers are not easy to find. This group includes Cockroach Labs, Databricks, Neo4j, Planetscale, Redis Labs, SingleStore, Yugabyte, Pinecone, TiDB, etc.

Due to this, in the table above, I only listed the public companies that have a database product as their core offering. Let’s now try to analyze both public companies and private companies.

Public Companies

The revenue from Snowflake, MongoDB and Elastic is really impressive. But what’s also very important is their Year over Year (YoY) growth[4], and gross/operating margins[5] as of January 2024:

| Company | YoY Growth | Gross Margin | Operating Margin |

|---|---|---|---|

| Snowflake | ~40% | 67% | Negative 40% |

| MongoDB | ~33% | 75% | Negative 15% |

| Elastic | ~19% | 74% | Negative 12% |

| Couchbase | ~16% | 87% | Negative 46% |

Both Snowflake and MongoDB are growing very well. In terms of their burn vs. return, none of these companies seem to be profitable, despite their high gross margins. It’s quite common that high growth companies in the SaaS space aren’t profitable yet, as investors are mainly betting into their path to profitability. These companies are fueling their growth through a myriad of investments, but they would be able to lower those costs down in order to manage cash balances and increase margins if needed. In the last two years, the belt has tightened and profitability is becoming more important as interest rates stay relatively high, but not important enough that everyone needs to be profitable. There are indeed good reasons to prioritize growth over profitability, such as network effects and amortizing operational costs even further. Having said that, the market (i.e., investors) won’t allow any company to do this, just the ones that are growing and have healthy cash reserves.

All this leads to one of the questions in the title of this blog. How do database companies make money then?

- Selling licenses for their software so that customers are able to run the software, whether that’s through a cloud provider or on their own hardware. (Snowflake does not have this option, since their product is cloud-only)

- Selling subscriptions to their cloud services. (All of 4 of the companies above have their own managed service)

- Premium packages for special support, training, courses, and access to certain features earlier.

- Professional services, i.e., billable hours of consulting time for help with setting up or using the product.

- Partnerships, and other more esoteric revenue streams.

The first and second bullets on this list are where the vast majority of the revenue comes for these companies (and it’s a bad sign if professional services corresponds to a large chunk of the revenue). A couple of notes on this:

- The licensing model for databases results in fixed costs being amortized across the install base, and very low operational expenses. Having said that, the market clearly prefers service-driven companies. This is because services are stickier, sales cycles are shorter and upselling existing customers is easier.

- When selling through a managed service, the financials become much more complex. Some cloud services like Databricks run the workload inside the customer’s infrastructure, whereas others run it on their own AWS/GCP/Azure accounts (e.g., Snowflake, MongoDB Atlas). This obviously has a tremendous impact on the revenue and margins, so comparing these across different businesses can be tricky.

Furthermore, MongoDB currently makes 60-70% of their revenue from their managed service Atlas, and it’s where they’re growing the most. As for Elastic, Elastic Cloud represents 35-45% of their revenue, but it’s also where they’re growing faster. For Couchbase, I wasn’t able to get the breakdown of Capella revenue to total revenue. Finally, for Snowflake, of course essentially 100% of their revenue comes from their cloud service.

Private Companies

How much revenue could the private database companies be making? As I already said, it’s very hard to say.

- As mentioned in the beginning of this blog post, SingleStore has announced that it’s at $100M+ ARR.

- In 2022, Neo4j announced that they’re at $100M+ as well.

- In 2021, Redis Labs announced that they’re at $100M+ as well.

- Databricks has announced that they’re at over $1B ARR and at a $1.5B revenue run rate.

But, for most of these companies, it’s very hard to know their financials. Certain websites, like Sacra.com claim to have some data about private companies, but the accuracy of this data should not be highly trusted. (Sacra has reports on only a few database companies: SingleStore, Neo4j and Cockroach Labs)

At the same time, these numbers aren’t extremely secretive. If you’re in the industry and ask around, you can sort of figure out where different companies are at.

Bigger Public Companies

What about Oracle, Microsoft, Google and Amazon? These are the absolute biggest players in the database market.

To get an idea of scale, in 2014, Satya Nadella announced that SQL Server had crossed the $5B revenue mark. But that was basically 10 years ago, which is a little bit insane when you look at the revenues from the other companies mentioned in this blog post so far.

Oracle has about ~50 billion USD in total revenue, but it’s very hard to know how much their database products actually contributed to that. In their earnings report for the end of the 2023 fiscal year, they reported $5.8 billion of cloud license and on-premise license revenues. But this includes several different products that are not MySQL/Oracle DB/etc., so we can’t draw any accurate conclusions from that.

But I did find a report from an analyst at Gartner from 2022 which goes into a lot of detail in terms of the database revenue from each of these companies. It’s slightly dated, but it says that AWS was at ~$23 billion USD of revenue from their various database services. Microsoft is very close at ~$22B, with Oracle at ~$17.5B, Google at ~$7.5B and IBM at ~$4.5B. This is fascinating! It also seems like MongoDB and Snowflake might catch up with IBM in the next 3-5 years, given IBM’s slow growth in the database space.

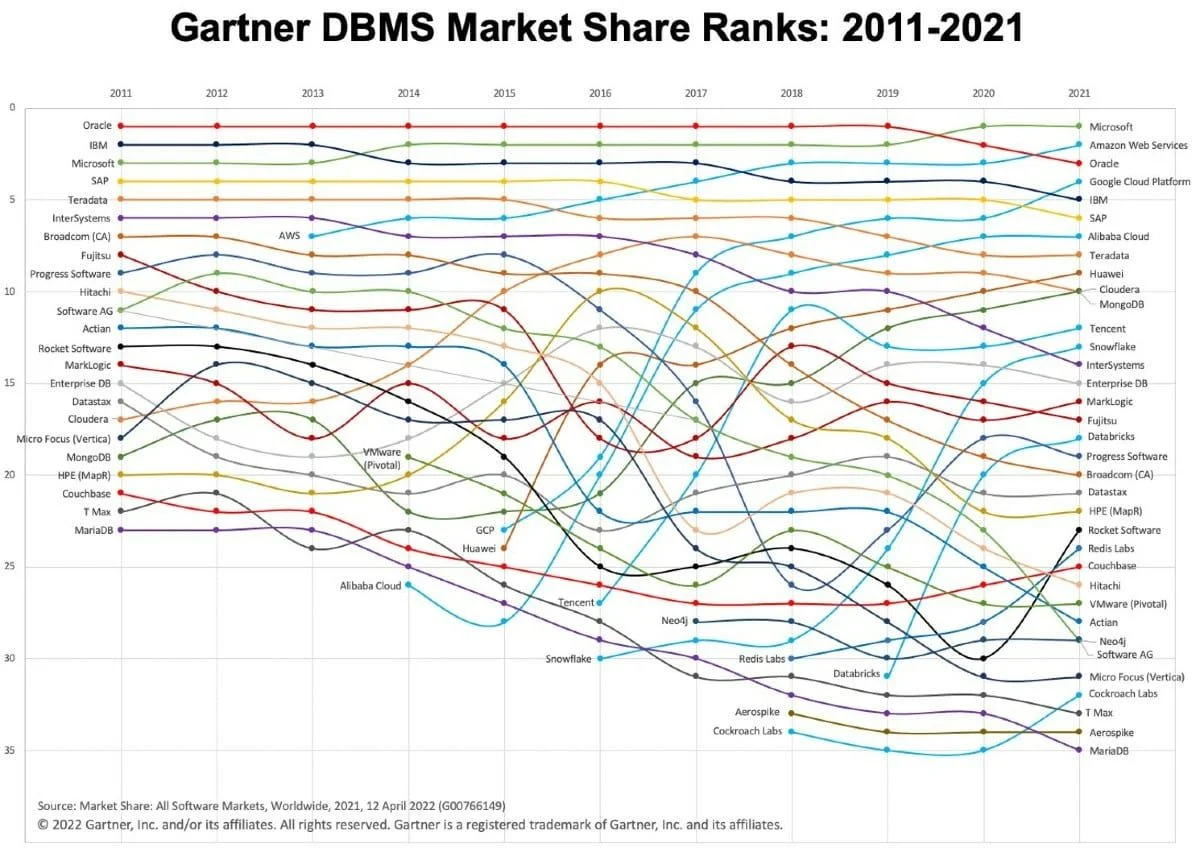

I also found this Gartner ranking of DBMS market share from 2011 to 2021, which is very interesting too:

Finally, I found this interesting tidbit from Gartner as well:

The DBMS market grew by 14.4% in 2022, reaching $91B. Cloud dbPaaS captured nearly all the gain, with cloud spend (55.2%) exceeding on-premises (44.8%). The nonrelational DBMS and RDBMS segment grew by 26.8% and 12.2%, respectively, while prerelational-era DBMS still declined at 10.1%.

The highlights for me are that:

- The DBMS Total Addressable Market (TAM), currently estimated at $91B by Gartner, is one of the largest in the enterprise software sector (if not the largest).

- Cloud spend exceeds on-premise spend, and seems to be growing much more.

Wrapping Up

For me, learning about these things is really interesting, as well as very relevant for my day job. I also recently wrote about how to value your stock options as a startup employee in this space, and that post is related to this one in some ways.

So, even though I mainly wrote for myself, I hope this has been useful to others as well.

Feel free to reach out on Twitter!

(Thank you very much to my proofreaders Micah, Pranav, Luís, Pedro and Alex.)

[1]: This blog post was written in mid-January 2024, and the data is obtained from a recent issue of a fantastic newsletter called “Clouded Judgment”. Their sources are “Bloomberg, Pitchbook and company filings”.

[2]: This is last 12 months revenue which is different from Annual Recurring Revenue (ARR).

[3]: MariaDB announced a yearly ARR of $55.0 million in mid 2023.

[4]: I calculated this by comparing their “Last 12 months Revenue” from this month and from 1 year ago. It’s not perfect, but for the purposes of this blog post, all we need is a rough estimate.

[5]: The gross and operating margins were also obtained from the same recent issue of “Clouded Judgment”.